Welcome! to

eHomeLoan

®

Residential loans are available.

Whether you want to buy a home, refinancing, or taking out another type of home loan.

Come Join the Technological Revolution with us !!!

We are offering FREE solar panels to selective borrowers!

Call us and find out if you qualify to enjoy free electricity!!

And your home value goes up significantly, as you now own the panels.

eHomeLoan

®

We offer a variety of services for all your home financing needs, including, but not limited to:

- Purchasing & Refinancing

- Debt Consolidation

- Residential Mortgage Loans

- Conventional, FHA, and Jumbo Loans

- Expert Loan Consultation

- Very Aggressive Pricing

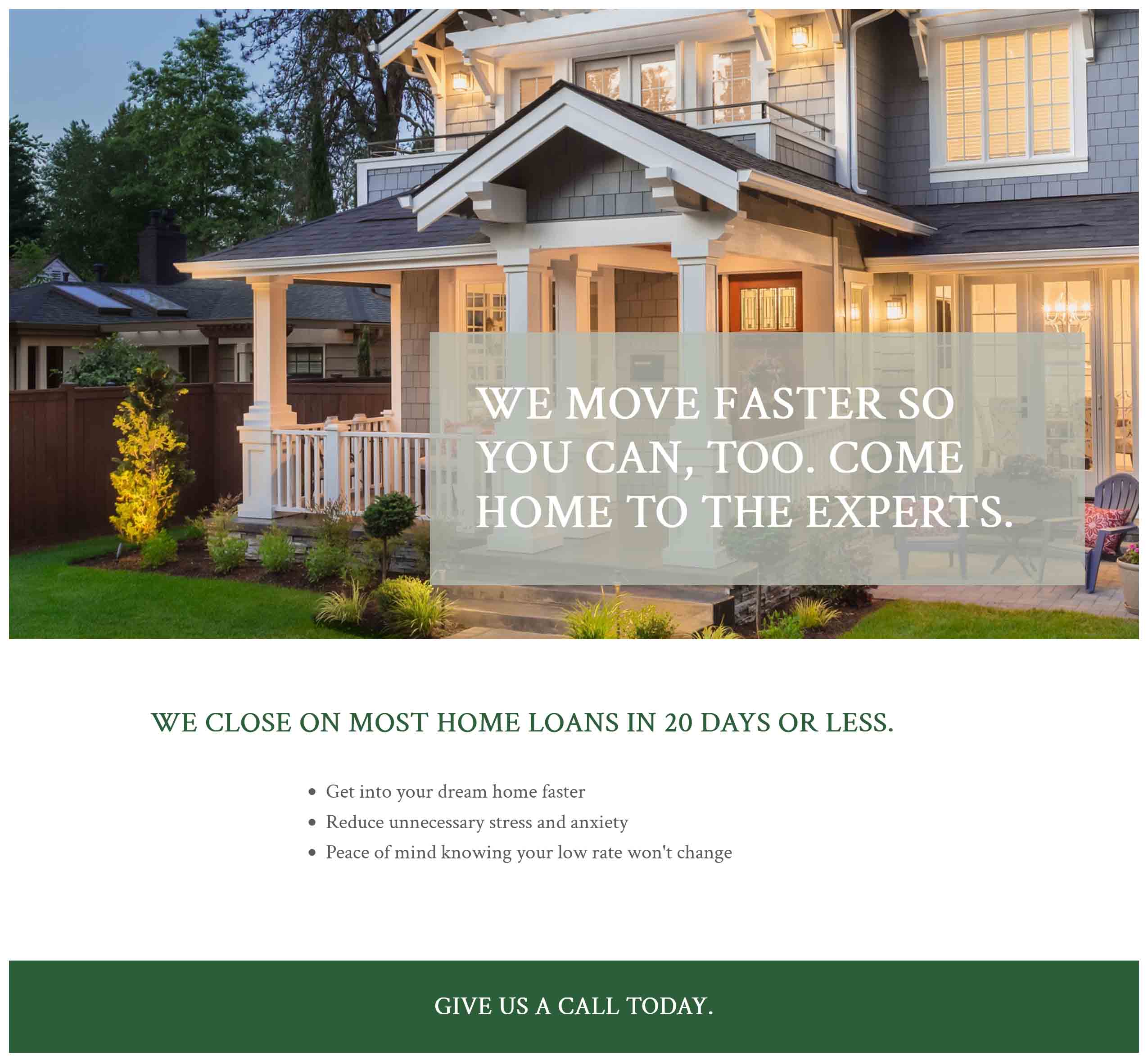

- Timely Performance

- Quality Customer Service & Communication

eHomeLoan

®

Services

Home Loan

Refinancing

Buy a Home

Home Mortgage

About eHomeLoan

®

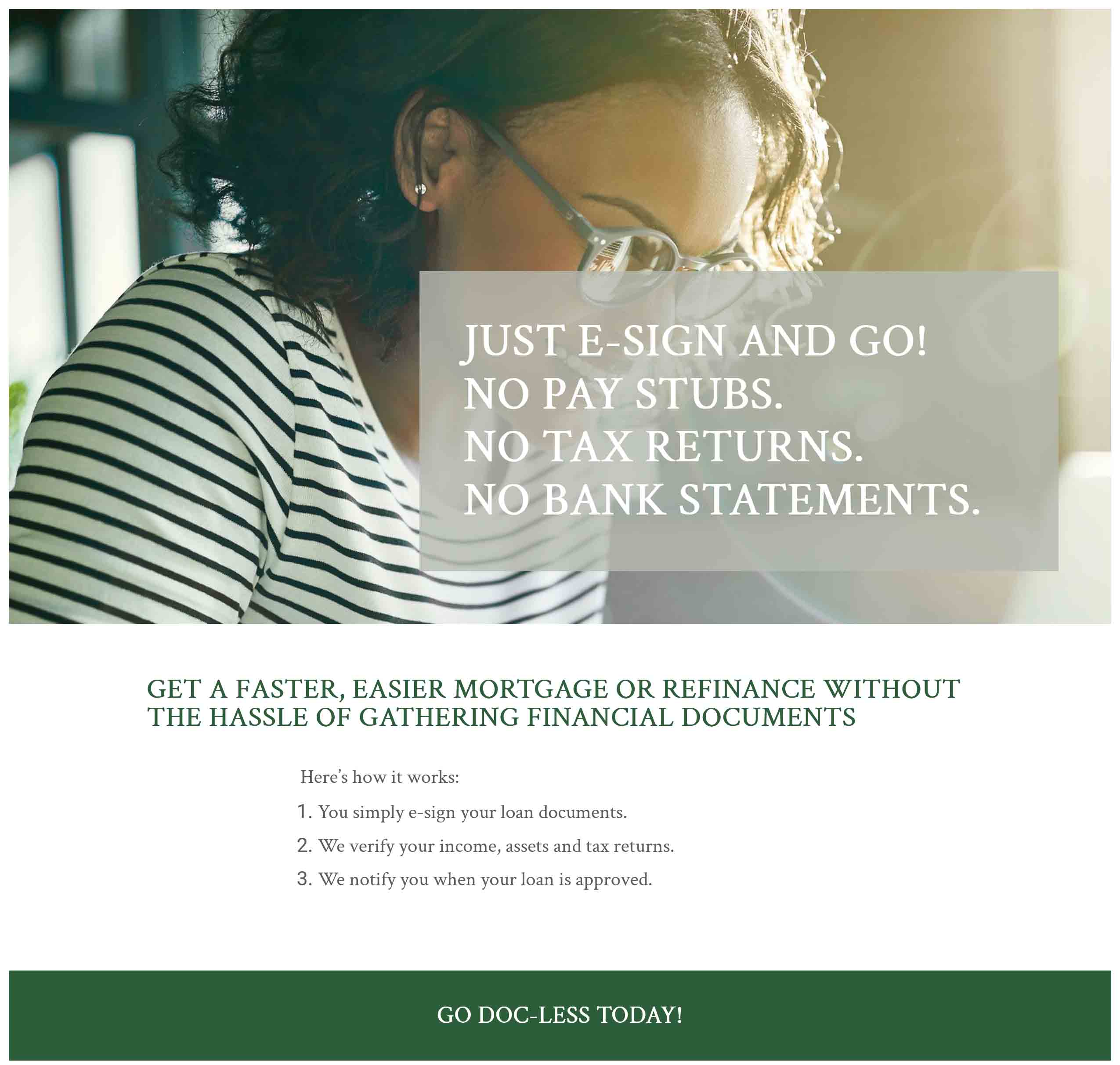

Residential loans are available through eHomeLoan® Whether you want to buy a house, refinancing, or taking out another type of home loan, our loan officers are available at your ease and comfort, and are here to guide you through the process. Do not worry about filing a bunch of paperwork, our loan processors will walk you through the entire process. Its Quick & Easy loan process. We have helped borrowers with low credit scores, and have allowed 100% gift funds and low down payments. Call us today at (312) 838 5810.

eHomeLoan® has a desire to keep customer satisfaction high, keep steady communication when needed, and last but not least, our goal is to help you purchase your dream home or refinance your existing home loan. We also take pride in giving back to the community. We often take it upon ourselves to give back to the communities in which we live and service on variety of levels, and at every available opportunity.

STATE OF ILLINOIS COMMUNITY REINVESTMENT NOTICE The Department of Financial and Professional Regulation (Department) evaluates our performance in meeting the financial services needs of our community, including the needs of low-income to moderate-income households. The Department takes this evaluation into account when deciding on certain applications submitted by us for approval by the Department. Your involvement is encouraged. You may obtain a copy of our evaluation once the Department completes our first evaluation. You may also submit signed, written comments about our performance in meeting community financial services needs to the Department. We will update this notice when our first evaluation has been issued.

WHY CHOOSE US?

FREQUENTLY ASKED QUESTIONS

There are a number of factors that will effect yours borrowing capacity for a home loan including the amount of income, expenses, liabilities and the value of the security of the property.

It depends what type of product you have. If you’re on a fixed rate deal, your repayments will stay the same until the fixed rate term ends. If you’re on variable rate mortgage your monthly repayments will increase.

We are generally willing to finance home purchase up to 96.5%, depends upon the individual circumstances.